Our approach: with currency discipline.

The Contribution deploys diaspora capital into trade finance transactions that are short-tenor (typically 3–6 months), asset-backed (linked to identifiable goods and trade flows), and hard-currency denominated (USD / GBP / USDC). Each transaction is designed to balance commercial returns with operational realism.

- Short-Tenor: Typically 3–6 months to minimize risk.

- Asset-Backed: Linked to identifiable goods and trade flows.

- Hard-Currency Denominated: USD / GBP / USDC to mitigate currency risk.

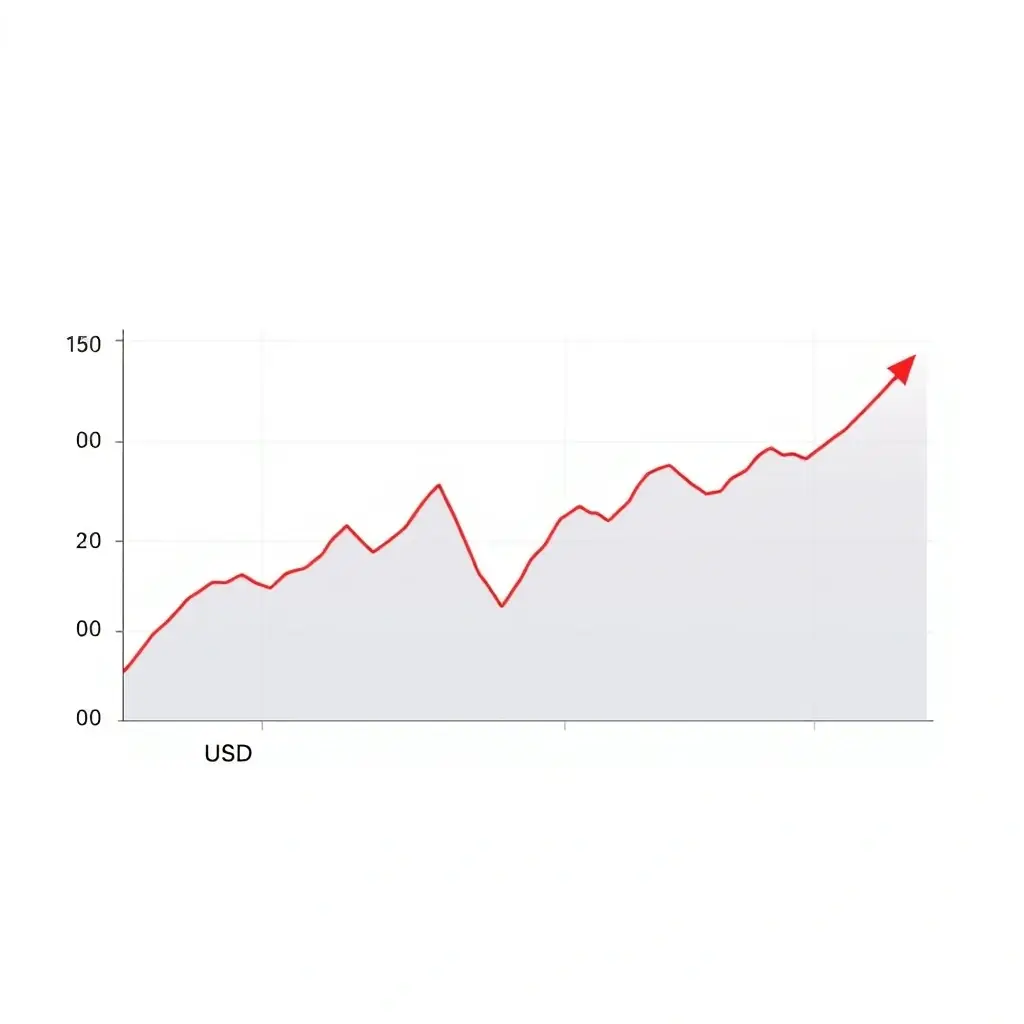

Nigeria's Currency Volatility with Strategic Solutions

In Nigeria’s dynamic currency landscape, The Contribution employs intentional structuring to mitigate risks. We prioritize hard-currency units of account, USD-linked trade flows, and short durations to minimize exposure. Our approach is designed to provide stability and predictability in volatile markets.

- Hard-Currency Units: Denominate transactions in USD, GBP, or USDC.

- USD-Linked Flows: Focus on trade activities with inherent USD cash flows.

- Short Duration: Reduce exposure with transaction tenors of 3-6 months.